(updated 03/2022 with my earnings as an appraiser, added at the end of this article)

As a real estate appraiser, you may work in a variety of positions at different types of employers (i.e. an appraisal firm or financial institution) or you may own your own business where all work is fee based. The amount you earn as a real estate appraiser will depend on your level of certification, years of experience and level of business IQ.

So, how much to real estate appraisers earn? The short answer is that they may earn anywhere from $35,000 per year to $200,000 per year. There are many reasons for the large range. But before we read why, here’s The Bureau of Labor and Statistics stats on appraiser earnings: The median annual wage for real estate appraisers is $58,650 (May 2020). The lowest 10 percent earned less than $32,990 (likely part-time), and the top 10 percent earned more than $107,090.

Here’s a chart I created of data provided by the Appraisal Institute of annual incomes for all valuation professionals.

The amount you can make as a real estate appraiser is determined by many factors.

Employed By a Company

You may work as an in-house review appraiser at a local or national financial institution, appraisal management company or government sponsored enterprise (Fannie Mae). Financial/lending institutions need in-house appraisers to review work done by appraisers they’ve hired who provide an opinion of value for the house they are taking as collateral for the mortgage loan. Part of the underwriting process is to ensure the reports completed by the assigned field appraisers are credible, reliable, accurate and void of any fraud or detrimental errors. As an employee, you will enjoy the benefits of steady pay (hourly or salary) and benefits (insurance and vacation).

You may also work for an appraisal company as a field appraiser. The arrangement may either be salary you may split the fee of the assignment. A typical fee split may be 50%/50% or 75%/25% [You/Firm].

Consider that salary is based on a standard 40 hour work week and you or may not receive OT pay for any hours beyond. Compare this where your earnings are fee based. The more hours you work the more appraisals you can do. The more appraisals you do, the more money you can make (and time being your only limit, as long as you have steady supply of appraisal orders).

Approximate Earnings:

AMC:

Appraisal Reviewer: $45,000-$85,000

Chief Appraiser: $45,000-$90,000

Lending Institutions:

Appraisal Reviewer at Local Bank: $45,000-$80,000

Appraisal Reviewer at Large Bank: $65,000-$125,000

Appraisal Firm:

Field Appraiser Salary: Salaries may range from $35,000-$75,000 depending on your years of experience. Being a partner in the firm with a share in the firm profits could substantially increase salary/earnings.

Field Appraiser Fee Split: ~$60,000-$130,000+

A typical fee split may be 50%/50% or 75%/25% [You/Firm]. The amount you earn depends on how efficient (and hard and smart) you work. If you earn $300 on a $400 appraisal (low end) and you can do 5 per week that’s $1,500/week. If you work 48 weeks out of the year that is $72,000, for example. Depending on the assignment type, complexity and location of the property, the fee could be more ($400-$750). In 2021, I received rush appraisal fees up to $1,400 due to the competition between lenders and low interest rates. It is not unrealistic do to 6-7 appraisals per week and a typical average appraisal fee can be about $450 for a standard single-family house. At 75% fee split, 6 appraisals per week for 48 weeks is $97,200.

Self-Employed/Owner of Appraisal Business

Field Appraiser: ~$90,000-$150,000+

You keep 100% of the fee you receive for the assignment. You set your own fees, however you may adjust the fees based on your clients. Fees may range anywhere from $400 for a basic one-family property to $800 for a complex 2-4 family property. Hypothetically, if you completed 4 basics and 1 complex, that’s $2,400 per week x 48 weeks per year is $115,200. Keep in mind that there are costs to running your own business, plus additional taxes. However, holding a position at an appraisal firm may include many of these expenses, so the actual earnings will be a little less when you are completely independent. You could reasonably complete 7-8 appraisals per week and work 50 weeks out of the year to further increase your earnings. I am personally able to complete 6-7 appraisals per week working a steady 40-50 hours.

How to make upwards of $200,000 per year

You own the firm and you give the assignments your company receives to other appraisers in your company you have an agreement with. You get the business and take care of the expenses as an incentive and you offer perhaps a 75%/25% or 50%/50% split. Having 4 or 5 appraisers in your office plus yourself can substantially increase your earnings well into the six figure range (but takes a good plan and lots of work).

How Much Do I Make as a Real Estate Appraiser?

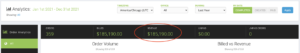

As of today (11/15/2019), I’ve billed $144,357 over the prior 12 months. Here’s a screen shot of my billing analytics:

That’s how much I billed. How much did I make? I am not an employee, but I do not own my appraisal business. I have an exclusive contract at an appraisal firm that provides work. In return, I give up a portion of the fee. I receive 70% of the billable amount. But the firm also provides office space, EO insurance, software, office management and many other things, if I choose to use them. It is a trade-off. I could own my appraisal business and take 100% of the $185,190 and forgo these things completely. I instead take $129,633 because it is the setup the currently works for me. I also work not more 50 hours/week. I could work more hours and on the weekend to increase my portion to $140,000+. But I like having work/life balance.

That’s how much I billed. How much did I make? I am not an employee, but I do not own my appraisal business. I have an exclusive contract at an appraisal firm that provides work. In return, I give up a portion of the fee. I receive 70% of the billable amount. But the firm also provides office space, EO insurance, software, office management and many other things, if I choose to use them. It is a trade-off. I could own my appraisal business and take 100% of the $185,190 and forgo these things completely. I instead take $129,633 because it is the setup the currently works for me. I also work not more 50 hours/week. I could work more hours and on the weekend to increase my portion to $140,000+. But I like having work/life balance.

If you’re curious about becoming an appraiser, watch my video course made by a State Certified Appraiser (me) that provides an in-depth look into the profession! I also take you on real inspections (8 different appraisals!) to give you an idea of what it’s like to perform appraisal inspections. If you have questions, leave one in the comments!

When Should You Take The Appraisal Courses?

It is not required to take the required appraisal courses before finding a mentor.

It is not required to take the required appraisal courses before finding a mentor.

However, I suggest taking the courses first for three reasons:

1) It will help you determine your level of interest and aptitude for actual appraising. Maybe you’ll change your mind after going through the courses, or maybe you’ll become much more interested. I offer an eBook about being an appraiser, but the courses will show you actual appraising and you’ll do it in theory by completing samples (case studies).

2) If you find a supervisory appraiser, he/she may tell you to come back later once you complete the courses for the trainee level (at a minimum) and obtain the trainee license, which could take two months, depending how quickly you can complete the courses. In the meantime, someone else could take your spot.

3) Your experience hours don’t count until you’ve taken the courses and obtained your trainee license. So if you wait to find your supervisory appraiser before taking the courses, you’ll lose two months worth of experience hours (or however long it takes you to get through the courses). You’ll get the experience, but the hours won’t officially count.

Here’s an example of a trainee posting from Craigslist illustrating this:

“Certified Residential Appraiser looking to take on a trainee… Preferable applicant will have a minimal 2 year degree and will have completed all required basic level training to acquire an appraiser trainee license. Please submit a resume for consideration.”

Of course, if you find a supervisory appraiser who is willing to take you on immediately even before you complete the courses or obtain your trainee license, do it! You don’t want to lose the supervisory appraiser. Just accept the loss of initial “log” hours for the immediate opportunity you have.

Interested in Appraising? Check out the Ultimate Appraiser Career Guide!

Hi Chris, I was curious as to how you are able to get large fees. I currently work for a company (basically an AMC, but they claim they are an appraisal company, however they are owned by the AMC, so basically an AMC). The AMC charges $700 to $750, the appraisal company (basically the same company as described above) will set the fee for the appraiser at $300, but again they claim they are the appraiser, and then they pay me $200. I am pretty new (CR license for a year), but am really disappointed in the pay. I initially thought “no way am I going to work for that fee, its not much more than I made as a trainee”, but then I talked to a guy I met who works for an AMC in my area, and he told me that my pay rate was pretty good, that his guys get paid $180, and they are more experienced (they have 55 staff appraisers making this). Coming for a realtor background, I was thinking that appraisers made a good living, but I have had to take out loans just to pay my living expenses, and I did 230 reports last year. I am probably going to leave the profession if I cant find better wages, with all my expenses (mainly auto & gas), and the hours I spend (avg about 60 hours a week), I could make more money working at Wendy’s. Any advice would be greatly appreciated, as I love the job, but I cannot survive with these types of wages.

Work for an actual appraisal shop (not owned by an AMC) that has a good amount of direct clients (smaller, local lenders and credit unions) and is very selective on the AMC clients. Most of our direct lender clients pay $400-$600 for a standard 1004URAR. Many AMC clients are $375-$425.

However, keep in mind that you won’t get paid much more than a trainee (unless you have your own clients) because you’re not that much more experienced being just one year in. But you will be. As you become more experienced you should receive a higher fee. If not, find a better place to work. Don’t leave an entire career based on one low paying employer. Larger employers, especially AMCs, will pay the lowest.

Of course the next best thing from direct client is opening your own shop and getting own clients. Then you can take of the 100%. But that’ll be in future, but not too far, because you’ll need to become certified and also get more experience.

I recommend finding smaller appraisal firm to work for, either a one-man shop or up to 10-15 appraisers.

As you become more experienced, you will get faster. I did around 280 reports last year. Other appraisers in my office did many more. Also, take advantage of technology. Go paperless, use mobile apps for notes and sketches, use sync apps to import field data and MLS data directly into the report, if you’re not already.

There are many other things to consider. Are you an employee? Do you have benefits, paid vacation, sick leave and insurance? Is your software, MLS fees, license fees and computer expended paid for? That would soften the low amount you are getting. I hope the $180 the other appraiser gets receives these benefits. If not, I couldn’t possibly understand why anyone take such a low fee unless in saturated markets like LA, NYC, Chicago and Florida, etc.

Is the Appraisal a flat fee or a percentage of the value of the house?

(I know the appraisers are the one to calculate the value) I was wondering

if this was a good profession to get into, if you live in Hawaii, because of the High Real Estate prices?

It’s always a flat fee that varies depending on the complexity of the assignment. It is never based on the value of the property. High real estate prices don’t always mean a busy market. Usually the better the interest rates the busier you’ll be as an appraiser.

I am currently obtaining my bachelors degree and have one semester left. I am working with a local appraisal firm and we have been discussing my future as an appraiser. The owner is willing to train me and I am planning to get my trainee license within the next three months. However, when we were discussing split fees, I was a little apprehensive. As a trainee, I would only get 30/70 (Me/Owner), then once I become licensed, it would bump up to 40/60. The average appraisal in my area is $400. Therefore, say I did 6 appraisals a week as a trainee, I would only be making $34,560 a year. I am extremely driven and am excited about this career. I am considering negotiating for 40/60 as a trainee and then 50/50 once licensed. If I am doing more appraisals, then the owner is not necessarily hurting from this. I would be making her more money- as she only has 2 other appraisers under her at this time. Also, I might be in a different market a year from now. I might be an hour away (still working for the company, but in a different market. I would be mostly by myself). What would you do?

30/70 sounds about right for just starting out under the trainee license. I’d say a more typical fee split for newly licensed is 50/50, then increasing with experience and more once you become certified. But it depends how quickly you become licensed. For example, four years as a trainee matters more than one year as a trainee and one year licensed. Experience matters more. There’s nothing wrong with trying to negotiate a higher fee split. A proper fee split also depends on other expenses paid by the the owner/office, if she covers things such as license fees, MLS fees, software fees, courses, etc.